This guide was initially published by @dmon#8604 as a Google Docs document. During the conversion of this guide, @dmon#8604 is a Team member and Trusted Member in LKS.

With crypto, there are derivatives known as perpetual futures contracts. Perpetual futures contracts are essentially agreements to purchase the underlying asset at a certain price. The contracts in crypto are perpetual, meaning they never expire.

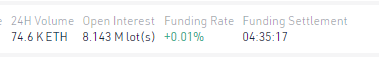

This is why a funding fee is associated with opening a futures position on any coin. Each coin has its own funding rates and it is something to keep in mind while trading because if you hold it for too long, it may eat into your profits.

How It Works

Using the example above, let’s say you want to open 1 ETHUSDTPERP contract. This would correspond to the perpetual Ethereum contract itself. Its funding rate is 0.01% of your supplied capital every time the funding settlement reaches its timer.

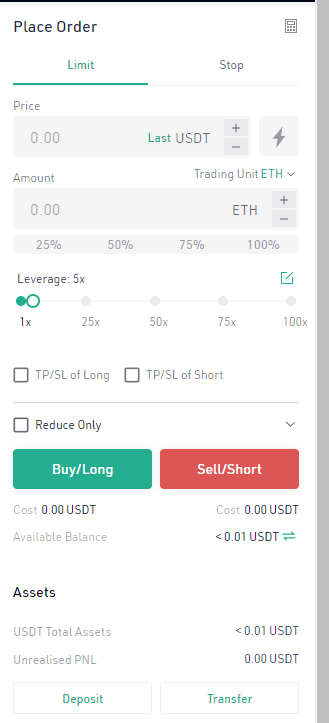

The slider (on the right) of Kucoin Pro’s Futures UI allows you to change a slider to adjust your leverage. If you are not trading with a KYC (also known as Know Your Customer) verified account, the limits can only go up to 5x.

In this example, we can look at this specific contract:

1 ETHUSDTPERP @ 4800 w/ 5x

To buy a contract with a position size of 24,000 USDT, your leverage should be 5x with an initial capital of 4,800 USDT.

When trading with leverage, every 1% move will correspond to a 5% move on your initial capital. So in this instance, if ETH (otherwise known as Ethereum) moved up by 1%, your position would be in profit by 5%, and vice versa.

For those that don’t know what leverage is, it means you are borrowing money in exchange for the collateral you provide for a bigger trade size. When trading with leverage, make sure to trade responsibly. Heightened risks can occur when trading with money you don’t have.

What If I Lose Too Much?

Thankfully, you can only lose the initial capital you supplied for the contracts due to the automated liquidation that Kucoin is programmed with. If based on the contract shown above, in theory, if ETH dropped 20%, your position size would be liquidated of the full 4,800 USDT that you used to buy the contract.